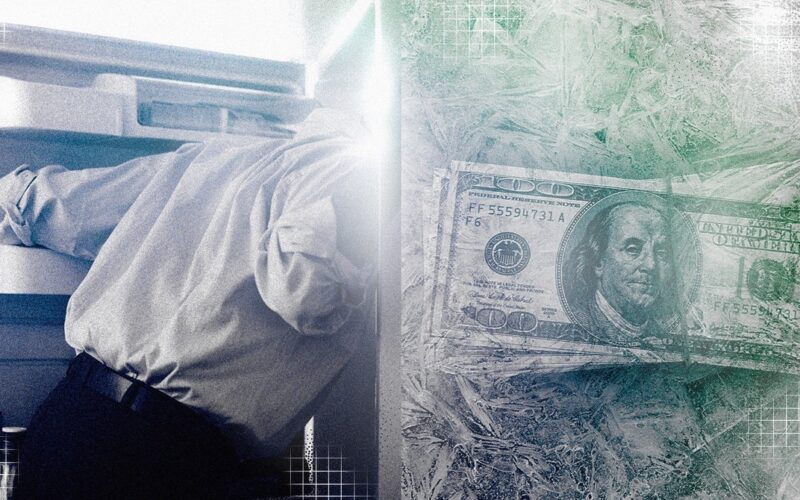

“People make fun of me about the fridges,” said Tassos Stassopoulos. “I am fridge-obsessed.” As the founder and managing partner of Trinetra, a London-based investment firm, Stassopoulos has pioneered an unusual strategy: peeking inside refrigerators in homes around the world in order to predict the future—and monetize those insights.

By the time of his refrigeration revelation in 2009, Stassopoulos had already gained a reputation for his maverick process: Where other investors typically relied on market data and forecasts from big consumer-products companies to deduce what people in, say, India might start purchasing in the future, Stassopoulos spent days traveling around the country, asking them himself. He found the ethnographic process fascinating and threw himself into it, visiting informal settlements and working-class neighborhoods to chat with people for hours—but he still wasn’t getting the information he wanted. “The problem is that I was asking people, ‘OK, assume you get a salary increase. How will your diet change?’ They’d all say, ‘I wouldn’t change anything,’” Stassopoulos explained. “But we know that as people get richer, their diets change.”

One afternoon he was in the city of Aurangabad, a couple hundred miles inland from Mumbai, interviewing a woman who had just given him that exact response. Her family was quite poor, and what little food she had in the house was very traditional—pulses, rice, and pickles. On a whim, Stassopoulos asked the woman if she’d mind taking him shopping. He gave her some rupees and followed her to the corner shop, where she bought Cadbury chocolate bars, Coca-Cola, and some packaged savory snacks—items that were very different from the foods she currently fed her family, but that Stassopoulos had repeatedly documented in the fridges and cupboards of people one socioeconomic class above hers. “I realized that the answer is the fridge!” he said. “The fridge could tell me how people would behave once they had some extra money—before they even know it themselves.”

Stassopoulos started grouping his photographs of fridges by income to see how their contents evolved. What emerged was a journey, starting with a poor family’s acquisition of their first fridge. “For them, it’s an efficiency device,” said Stassopoulos. They use it to store either the ingredients to make traditional dishes or the leftovers from those dishes. Upon their ascent into the middle class, the fridge starts to include treats and international brands—soft drinks, beer, and ice cream. “You have some disposable income for the first time,” said Stassopoulos. “You want to provide all these things that your family was previously deprived of, and you want to show off while doing it.”

Once a family becomes truly affluent, their fridge will shift again. Where one brand of ice cream in the freezer was an indulgent treat for all the family, multiple brands of ice cream reveal that frozen desserts are now normal enough that individual family members can dislike each other’s preferred flavors. “Before, it was just, Yes, we can get ice cream,” he said. “Now it all becomes about me: I like chocolate and I don’t like strawberry.” Ingredients from different cultures as well as items marketed as healthy—fat-free, diet, or probiotic foods—also show up on refrigerator shelves at this income level, reflecting, in Stassopoulos’ rubric, a desire for self-improvement and, beneath it, a transition toward individualistic, Western values.

The pinnacle of his pyramid is reached once a fridge contains foods that express collective virtue: fair-trade, organic, cruelty-free products in reusable packaging. “This is where the Nordics are,” he said. “India is mostly in this efficiency stage, China is at the indulgence stage, and Brazil is already on the healthy stage.” Based on Indian fridgenomics, he decided to invest in dairy processors, companies that turn milk into butter, cheese, yogurt, and ice cream. He predicted that these were the items Indian families would add to their diets as their incomes increased—and recent data showing double-digit growth in sales of value-added dairy products, not to mention his above-benchmark returns, have proven him correct.

Source link

lol