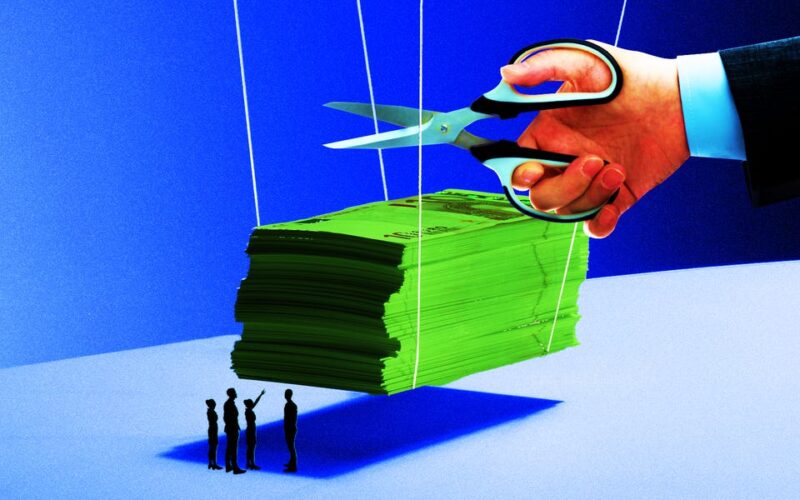

- The US economy looks strong, but that’s tough news for those hoping for cheaper borrowing costs.

- Borrowers have been waiting for lower rates to improve the affordability of everything from homes to credit cards.

- However, the economy and the job market may be too strong to warrant steep rate cuts in the near term.

The US economy looks like it’s on course for what Wall Street has long considered the dream scenario — but that could actually diminish the financial relief many Americans have been waiting for.

The no-landing scenario — in which the economy dodges a recession and continues to grow — was coveted by investors for its implications for stocks as economic strength props up the ongoing bull rally. However, the risk for everyday Americans is that rates fail to come down enough to provide meaningful relief.

The case for the no-landing outcome was revived by the blowout jobs report last Friday, which showed that the economy added 254,000 jobs in September, far above economists’ estimates. Meanwhile, job gains for the months of July and August were also revised upward.

Those are promising signs that the economy hasn’t materially weakened after years of higher interest rates, and that the Federal Reserve may not need to loosen monetary policy as much as previously thought.

This week, Ed Yardeni, the president of Yardeni Research, said he thinks the Fed is done cutting rates for the rest of the year.

“September’s strong employment report and upward revisions in July and August murdered the hard-landing scenario,” Yardeni said in a note to clients this week.

As the no-landing scenario becomes increasingly priced into the bond market — the 10-year Treasury yield is above 4% this week for the first time since August — the impact is being felt in a key segment of the economy: housing.

The 30-year mortgage rate has crept higher, not lower, since the Fed delivered its big rate cut. How further rate cuts impact mortgage costs is up in the air, and will depend on how the bond market reacts to future data.

There’s a secondary risk here, too. As the economy reaccelerates, inflation could become a problem again, solidifying a higher for longer interest rate outlook that many had abandoned after the Fed’s jumbo rate cut last month.”Stronger job creation may result in a rise in prices which further complicates the Fed’s job. We think the jobs report removes the chance of another 50 bps rate cut at the meeting in November,” Megan Horneman, the CIO of Verdence Capital Advisors, said on Monday.

Steven Blitz, the chief US economist at TS Lombard, echoed that sentiment in a note on Tuesday.

“The Fed will not get the funds rate down to 3%, but the terminal rate for this round will nevertheless end up too low and be kept there for too long. Inflation subsequently rebounds, and the Fed is back raising rates sooner than anyone expects,” Blitz said.

“The risk of this bad outcome arriving sooner than later rests with what has now become the biggest risk in the Fed’s cut and aggressive guidance, and the one markets are not pricing — that there is no landing at all.”

For American consumers hoping for relief from high borrowing costs for the past two years, these are unwelcome developments.

The interest rate on credit card loans from commercial banks rose to 21.7% in August, the highest rate recorded in at least the last 20 years, according to Federal Reserve data.

The rate on 48-month new auto loans also rose to 8.6% in August, the highest in more than a decade.

Consumer mortgage originations at large banks also plunged to $44 billion in August, down from a peak of $212 billion in 2021, Philadelphia Fed data shows.

“With benchmark interest rates coming down, most prospective borrowers don’t feel relieved of high borrowing costs,” according to Mark Hamrick, a senior economic analyst at Bankrate. “Financing and affording big ticket purchases is still a stretch for many Americans, whether looking at homes, cars or household items that might be paid for using a credit card.”

Source link

lol