(Michael Vi/Shutterstock)

Investors in Snowflake breathed a sigh of relief this week when the cloud data warehouser reported solid revenue growth for its first quarter and raised its guidance for the rest of the year. But questions still remain over its long-term growth, which the company is hoping that artificial intelligence will power. The company’s acquisition this week of assets of TruEra fits that mold.

Snowflake on Wednesday reported $829 million in total GAAP revenues for the quarter ended April 30, 2024, representing a 33% increase over the same period last year. It reported 14 cents per share, which was 6% increase over last year’s first quarter figure, but below analyst expectations. Its shares, which are traded on the New York Stock Exchange, are down about 4% from Wednesday’s close.

The Bozeman, Montana company also raised its guidance for the second quarter and the rest of the year. It now expects second quarter revenue to be in the $805 million to $810 million range, representing a year-over-year growth rate of 26% to 27%. On a full year fiscal 2025 basis, Snowflake now expects revenues to be $3.3 billion (up from previous guidance of $3.25), which would represent a 24% increase over fiscal 2024 results.

However, those gains are offset by Snowflake’s forecasted non-GAAP operating margins, which are now expected to be 3% for full-year results, which is down from the previous estimate of 6% and much lower than last year’s actual results of 8%. That made Wednesday’s report a mixed bag for the cloud giant.

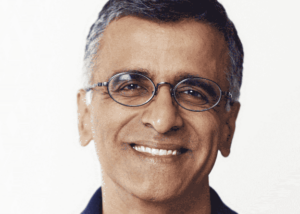

“We finished our first quarter with strong performance across many of our key metrics,” said Sridhar Ramaswamy, CEO, Snowflake. “Our core business is very strong. Our AI products, now generally available, are generating strong customer interest. They will help our customers deliver effective and efficient AI-powered experiences faster than ever.”

Snowflake today also announced its intent to acquire certain technology assets and hire key employees from TruEra, an AI observability platform. TruEra provides capabilities to evaluate and monitor large language model (LLM) applications and machine learning models in production.

Like most data companies, Snowflake is betting on generative AI to help drive sales. Last month, the company launched Arctic, a mixture of experts (MoE) LLM that customers can use to train models using data they have stored in Snowflake. These models can then be used to build GenAI applications, such as chatbots and AI copilots.

Companies are rushing to adopt GenAI technology to help them serve customers more efficiently, to build new experiences for consumers, and to empower employees with access to more information. However, a score of issues, ranging from data governance concerns to the tendency for LLMs to “hallucinate” answers to questions, has slowed the rollout of GenAI apps from internal testing to production.

Ramaswamy was brought in to replace previous CEO Frank Slootman following poor financial results in February. Ramaswamy joined the company one year ago with its acquisition of Neeva, which had developed a neural search engine that uses the same AI techniques as LLMs to provide better answers to searches.

Snowflake grew quickly over the past five years as companies moved their SQL data analytics workloads from on-prem servers to the cloud to take advantage of affordable storage and more flexible compute resources. The company currently has more than 9,800 customers, and has nearly 500 that spend $1 million or more per year with Snowflake.

Snowflake launched its Arctic LLM last month (Denis Belitsky/Shutterstock)

However, as Snowflake’s growth slowed at the end of fiscal year 2024, analysts questioned whether the company was in for a period of sustained decelerated growth. Wednesday’s report gave them reason to think that may not be the case.

“We estimate revenue growth will likely decelerate to a mid-to-high-20% rate by the end of the year from over 30% recently,” said Morningstar analyst Eric Compton. “If that deceleration continues, there are risks to our fair value estimate” of $187 per share, about $30 more than the stock’s current value.

Snowflake’s competitors are also eager to make hay out of questions about Snowflake’s business, including Ocient, a Chicago-based startup that develops a data warehousing solution optimized for the parallel IOPs of NVMe drives.

“Though customers have migrated their lower-hanging fruit workloads to the cloud, what we’re seeing at Ocient is their more complex, compute-intensive workloads require a different approach to working at scale,” Ocient CEO and founder Chris Gladwin tells Datanami.

With a $52 billion market cap, Snowflake has plenty of room to maneuver. And with its annual Data Cloud Summit 24 starting on June 3 in San Francisco, the company will have the spotlight to make big announcements, which you will find on these pages.

Related Items:

Snowflake Touts Speed, Efficiency of New ‘Arctic’ LLM

It’s a Snowday! Here’s the New Stuff Snowflake Is Giving Customers

Databricks Versus Snowflake: Comparing Data Giants

Source link

lol