- A senior Two Sigma quant researcher is leaving for Cubist.

- Kan Huang co-led a key machine-learning unit known as techniques forecasting.

- Jin Choi, Huang’s interim cohead, has been named sole head of the long-running techniques group.

A senior leader in one of Two Sigma’s key research units is leaving the firm for quant rival Cubist Systematic Strategies, according to people familiar with the matter.

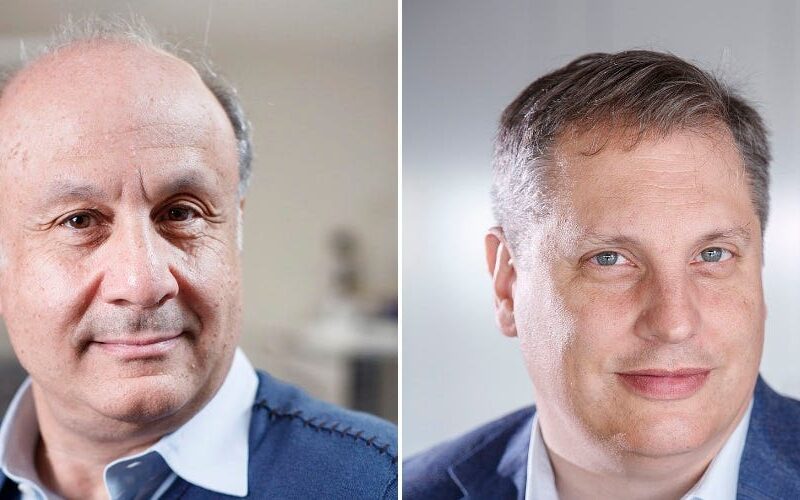

Kan Huang, a quant researcher at the firm since 2011 and an MD since 2018, has resigned from Two Sigma and is expected to join Cubist, the quant arm of Steve Cohen’s hedge fund Point72, according to four people familiar with the matter, who were granted anonymity to discuss private information.

Huang is a leader of a Two Sigma unit that develops machine-learning models and other advanced strategies from various data sources and trading signals. Referred to as “techniques forecasting” or simply “techniques,” the group is one of a number of teams employing machine-learning methods at the hedge fund, but it is among the longest-running and most profitable at the firm, according three people familiar with the group.

Huang’s offer to join Cubist was in the range of $30 million, according to people with knowledge of the move, though such deals are typically nuanced, spanning several years and accounting for variables including deferred compensation and bonus incentives. A spokesperson for Cubist declined to comment. Huang did not respond to requests for comment.

Huang and Jin Choi were named interim coheads of the techniques group in May after Ken Baron, a veteran leader of the firm, stepped down to begin charting “his course towards retirement,” according to an internal memo reported on by Bloomberg.

Choi, who has also been at Two Sigma since 2011 and a key member of the techniques group, has been named sole head of the group, a person familiar with the matter said. This is Huang’s last week at the firm, the person said.

Two Sigma, which manages $60 billion in assets, has undergone a rash of leadership changes over the last 18 months since it disclosed to investors that its billionaire founders, John Overdeck and David Siegel, were embroiled in a feud that was hampering the management of the firm. The most recent shift came at the end of August when the pair told investors they were stepping back from day-to-day management of the firm and installing as co-CEOs Scott Hoffman and Carter Lyons.

Ali-Milan Nekmouche, who was named CIO of Two Sigma Investments as part of the shakeup, was tapped in May to lead a new artificial intelligence and machine-learning team, including oversight of Huang and Choi’s techniques unit.

“Techniques” is also the group that housed Jian Wu, the former quant researcher who was accused by the firm of tweaking models without permission, resulting in his termination and an investigation from the Securities and Exchange Commission, people familiar with the matter said. The trading scandal, which came to light in 2023, is expected to result in a settlement with the regulator of as much as $100 million, according to a September report from The Wall Street Journal.

Source link

lol