(Phonlamai Photo/Shutterstock)

The average company is spending 30% more on the cloud compared to last year, and AI and generative AI are the big culprits, according to a new report issued today by Tangoe, a provider of expense and asset management solutions.

The cost escalation due to AI and GenAI is starting to turn some heads, according to Tangoe’s “State of Cloud” report, which found 72% of the 500 US-based FinOps practitioners surveyed say GenAI spending in the cloud is “becoming unmanageable.”

“GenAI cloud expenditure has now become an additional and major burden for FinOps teams – stubborn, escalating, and nearly impossible to manage without deploying a cloud cost management tool to get this under control,” Tangoe stats in the report, which it commissioned Vanson Bourne to put together.

The vast majority of companies have a GenAI strategy, although they’re at various points in the process. For instance, a recent Hitachi Vantara survey of IT leaders found that 97% of them consider GenAI to be one of their top five priorities. That matches a recent EY survey, which found that 95% of senior IT leaders say their organizations are currently investing in AI.

Boston Consulting Group recently published a study that found GenAI investments in 2024 have increased by 30%, the exact same growth figure from the Tangoe survey. The automation capabilities exposed by GenAI have made GenAI investments “an imperative” for companies to adopt it, BCD said.

Large companies are better positioned to acquire and run the GPUs necessary to train and run their own large language models (LLMs), as well as other types of compute-hungry models, not to mention to afford the human AI engineers and data scientists needed to turn raw unstructured data into an automated solution. But the majority of organizations are either developing their own GenAI apps in the cloud via the infrastructure as a service (IaaS) model or tapping into pre-built GenAI applications running in the cloud via the software as a service (SaaS) model.

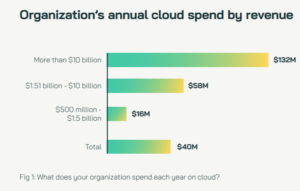

Tangoe found that the average organization’s cloud spend is currently $40 million per year, split across SaaS (28%), private cloud (28%), IaaS (25%) and unified communications as a service (19%), the survey found. Larger companies with $10 billion or more in revenue spend an average of $132 million per year, it found, while smaller organizations are spending substantially less.

Tangoe gleaned some other interesting tidbits from the survey, including that the average organization is spending nearly $2,600 per year on cloud software for every employee across all categories (SaaS, private cloud, IaaS, and UCaaS). It also found that cloud spending is rising at 92% of companies surveyed.

Not surprisingly, cloud repatriations are growing. The survey found that 95% of companies have plans to bring some cloud workloads back on-prem. However, 80% of the FinOps professionals surveyed say private cloud costs are “trickier to manage.”

“GenAI is creating a cloud boom that will take IT expenditures to new heights,” said Chris Ortbals, chief product officer at Tangoe. “With year-over-year cloud spending up 30%, we’re seeing the financial fallout of AI demands. Left unmanaged, GenAI has the potential to make innovation financially unsustainable.”

Related Items:

Is the GenAI Bubble Finally Popping?

Flexera 2024 State of the Cloud Reveals Spending as the Top Challenge of Cloud Computing

Source link

lol