Its CEO’s net worth dropped about $10 billion in a single day.

Bot Drop

Earlier this year, AI chipmaker Nvidia was riding high, enjoying a record-breaking valuation of $3.3 trillion.

But this summer, investors started asking some tough questions. Shareholders started getting cold feet over AI companies’ sky-high valuations, as CNN reports, with widespread skepticism causing stocks to come crashing back down.

As the company selling the shovels for the goldrush, Nvidia should be making money hand over fist. But instead, it wiped a massive $279 billion off its value on Tuesday, a precipitous drop of 9.5 percent in share price.

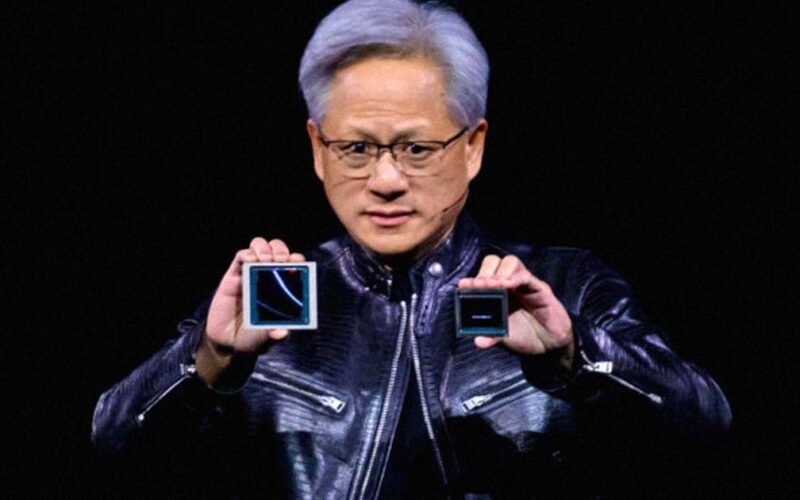

The slump even erased about $10 billion from CEO Jensen Huang’s personal net worth, his biggest single-day drop according to the Bloomberg Billionaires Index.

Something’s off, in other words, despite the company’s growing revenue.

Is this just the market’s correction to signs of a slowing economy? Are investors becoming wary of major investments in largely unproven tech that’s still far from turning a profit?

While it’s still too early to tell if Nvidia’s most recent troubles are a canary in the AI coal mine, there are plenty of signs to suggest that growing skepticism is starting to put a real damper on the hype surrounding AI.

Greatest Expectations

Tech giants have been pouring billions of dollars into expanding data centers to support insatiable AI models, but aren’t anywhere near seeing a return on their astronomical investments.

To reassure investors, tech CEOs have tried to argue that it’ll all be worth it once AI’s ambitions are fully realized, eventually. That line of reasoning, though, is clearly testing Wall Street’s patience. Analysts without a deep faith in AI’s long term value have repeatedly warned that all of that spending may not amount to much of a return in the end.

Thanks to its central position in the AI race, Nvidia’s stumbling shares have had tremendous knock-on effects, with shares of other related companies dropping as well.

Needless to say, there are plenty of other factors at play as well. Nvidia’s slump on Tuesday was likely also related to rumors of it receiving a subpoena for an escalating antitrust probe by the Department of Justice. (The company denied those reports.)

For now, the chipmaker’s stumbles still pale in comparison to its meteoric rise. Its shares are up a whopping 120 percent year-to-date, and Huan remains adamant that investments are paying off, telling investors last week that “people who are investing in Nvidia infrastructure are getting returns on it right away.”

But whether that will prove to be enough to reassure investors who are growing bullish on AI remains to be seen.

More on Nvidia: Nvidia Stock Falls as Earnings Show AI Isn’t Growing Revenue Like It Hoped

Source link

lol