It’s hard to be the king of AI.

Nvidia showed that AI demand is still high, more than doubling its revenue for this same period last year and projecting $32.5 billion in revenue for the next quarter.

But that came as no surprise to industry experts on Wednesday.

As large tech companies continue to inject billions of dollars into artificial intelligence, locking in demand for Nvidia’s valuable chips, the multitrillion-dollar company was largely expected to post strong quarterly numbers.

What’s working against Nvidia, however, are the sky-high expectations investors keep setting for the Silicon Valley chipmaker, especially as they get antsy over returns on AI investments, analysts and industry experts told Business Insider.

“The numbers are stellar,” Jacob Bourne, an analyst for Emarketer, told Business Insider. “The problem is that investors keep raising the bar on Nvidia each quarter, and the expectations have become unrealistic.”

Emarketer is a subsidiary of Axel Springer, which also owns Business Insider.

Similarly, Daniel Newman, CEO of The Futurum Group, a tech research firm, told BI that the second quarter numbers Nvidia showed were strong “but that level of good was already priced in” by investors.

By standard measures, Nvidia did more than just fine this quarter.

The company reported $30.04 billion in revenue this quarter, more than doubling its revenue from last year at the same period and beating analyst expectations of $28.86 billion.

Still, those numbers received a tame reaction on Wall Street.

What Newman described as “almost an irrational exuberance” around Nvidia was reflected in the company’s stock, which was down 6.9% after hours on Wednesday at the time of publication.

According to Bloomberg, “Going by the options market, Nvidia’s results are expected to send its shares careening nearly 10% in either direction in the session following the report.”

Questions also loomed over concerns around shipment delays for the company’s Blackwell GPUs, which are expected to replace Nvidia’s Hopper, ahead of Wednesday’s earnings call.

“The recent delay in Blackwell’s market release timeline added to investor jitters,” Bourne told BI.

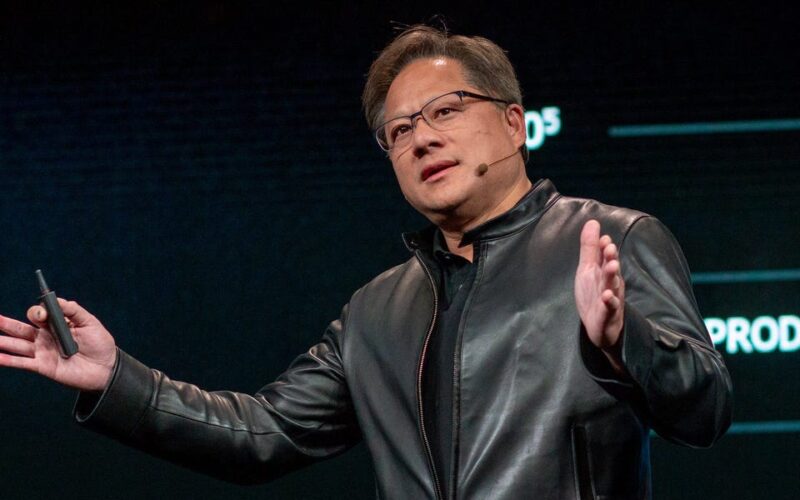

On Wednesday’s earnings call, Nvidia CEO Jensen Huang promised that the company would be shipping out billions of dollars worth of Blackwell GPUs by the fourth quarter — a metric that analysts warned was vague. Nvidia executives on the call remained vague about the anticipated gains expected from Blackwell despite investor follow-up Qs.

“Saying that they’re going to make several billion dollars this year on Blackwell — that’s a pretty big range,” Grace Harmon, connectivity and tech analyst with Emarketer, told BI.

Overall, experts said that Nvidia has largely tempered any concerns around Blackwell shipment delays, but it will be crucial for the company to deliver.

“We believe it will be harder for the company to beat expectations by wide margins; however, the company should receive a boost with the launch of its new Blackwell chips later this year,” Logan Purk, a tech analyst at Edward Jones, wrote.

Even as lofty expectations may work against Nvidia, Huang continued to set a high bar for the company’s near future.

“Next year is going to be a great year. We expect to grow our data center business quite significantly,” Huang said on the call. “Next year, Blackwell is going to be going to be a complete game changer for the industry, and Blackwell is going to carry into into the following year.”

Emma Cosgrove contributed to this report.

Source link

lol